The latest reports indicate that the world debt has reached an impressive $57 quadrillion and it is more than likely that it will keep rising.

Will this tendency ever stop? Is there a solution for this? What are the biggest problems that could arise from it?

Plain and simple, the world “owes” three times more than what it can produce. However disturbing this may sound, it is still “the elephant in the room”. (continued below)

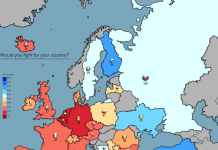

In the last decade, this rampant debt growth has been caused not only by “mature” economies (like Europe or North America), but also by the emerging economies:

China, for example, was the main contributor to this tendency in the last two years (2019 and 2020 and the emerging markets were the ones that witnessed a higher growth of debt percentage in the last decade.

As protectionist policies are spreading around the world (with the Trump Administration and Brexit being the most recognizable examples) in an age where economies have become more interdependent than ever and the banking system vulnerabilities continue to be evident, there is a growing concern that the world debt bubble could “burst” sooner than what we think.

Global trade growth has fallen below 2 percent, a sign that some of the necessary measures are not being taken.

Without proper growth stimulation, countries around the world will continue to have a hard time facing the redemption of market bonds and loans and these vulnerabilities will inevitably spread to other quadrants of our society, such as the banking system, companies and, of course, individuals.

–

You can follow Albert on Twitter. Or join the free mailing list (top right)

Feel free to comment on story below

Albert Jack books available for download here

Albert Jack – UK Albert Jack – US